This blog is taking a quick break from LICs to focus on this year’s annual report awards, annual report competition and annual report contest — the world’s largest of its kind. (This refers to, of course, the 2009 Vision Awards Competition hosted by LACP.) See you after the competition!

Taking a break!

Posted in Education

Rhyming Markets

Planning Ahead for the Week of October 12, 2009

Planning Ahead for the Week of October 5, 2009

October 2009 $SPY Long Iron Condor Update

Planning Ahead for the Week of Sep. 28, 2009

What a week it has been! I’m somewhat stunned that my predictions for the past week were so accurate. (See here.) To recap, I was expecting an opportunity to move out of the November Long Iron Condor (LIC) as the market moved temporarily lower.

My target date for a significant market reversal was Thursday, September 24, and that’s exactly when it arrived. In the interim, I’ve re-invested the proceeds of the November LIC into additional October LIC positions, which will be detailed later in this e-mail.

Heading into the week of September 28, there are some interesting choices that the market will be making. Here’s a recap of the possibilities.

A key resistance level on the SPY is right around 103.9–it matches up with August highs and provided support twice earlier this month. It’s also near the bottom of the current wedge we’re in. See chart on right for details.

So, if we do move past 103.85 next week, I will most likely buy back the sold puts at 101 (SWGVW) and ride the bought puts at 98 (SWGVT) as the market moves lower, keeping a tight stop on selling the second leg of this position in order to maximize profits. (I’m thinking a $0.05 trailing stop, which would give up $500 on 100 options but provides enough latitude to allow a significant move lower.)

The market can, of course, also move higher for a number of reasons. First, the “buy the dip” crowd may re-emerge after a weekend of sobriety. Also, it’s end of quarter, and many institutional folks may be eager to play catch-up in their holdings as client reports are about to be generated. Additionally, Yom Kippur traditionally marks the beginning of a mild bullish slant to the market. Finally, aside from Wednesday, every day of the week holds a historically bullish slant, offering a daily probability of 57% (Thu.) to 66% (Tue.) of moving higher.

CURRENT POSITIONS

To consolidate the Twitter-based updates from the past week, here’s where things currently stand:

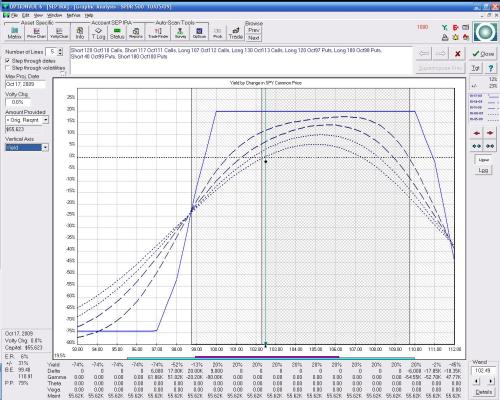

A 95/92 put spread, originally priced at a net credit of $0.62 and now worth $0.12–a 19% profit. (22% of Oct. LIC)

A 101/98 put spread, originally priced at a net credit of $0.43 and now worth $0.51–a 5% loss. (27% of Oct. LIC)

A 116/113 call spread, originally priced at a net credit of $0.20 and now worth $0.07–a 3.5% profit. (24% fo Oct. LIC)

A 114/111 call spread, originally priced at a net credit of $0.46 and now worth $0.21–a 8.5% profit (8% of Oct. LIC)

A 112/111 call spread, originally priced at a net credit of $0.27 and now worth $0.10–a 19.5% profit (17% of Oct. LIC)

That puts overall profitability for today at 7%, possibly 8% if SPY moves back to around 106. Peak profitability for this LIC remains around 18.5% on October 17, assuming we can remain between 101 and 110 by then. The nearest short-term threat is the downside risk of the 101/98 put spread, which I’ll be exiting if SPY reaches too far below 104–again, my tentative trigger is 103.85. The upside risk is minimal at the moment, but I’d re-examine things if SPY shot up to 108 or so.

For those who are interested, the current annualized yield for this sort of condor is 321%. Of course, we can’t maintain all condors through options expiration every month, but it’s a nice, aspirational target that isn’t reliant on market direction. On a $100,000 investment in this LIC, you’re earning just over $400 a day in time decay, including weekends. And that’s the kind of dividends that I’m happy to be invested in.

Posted in 10/09 Long Iron Condor, CLOSED: 11/09 LIC | Tags: $SPY, long iron condor, october, october 2009, SPYJG, SPYJH, SPYJI, SPYJJ, SPYJL, stock market, swgvn, swgvq, SWGVT, SWGVW, yom kippur

Planning Ahead for the Week of Sep. 21, 2009

Oct. $SPY Condor Adjustment

I’m not a big fan of adjustments to existing condors, but given the straight, six-day rise in $SPY, I think now is a good time to take preventative measures as technicals point to a potential breakout for the index.

In brief, I’m rolling the call side of this long iron condor from 106/109 to 109/112, taking a net debit of $1.06 on the former and net credit of $0.53 on the latter. This leads to a near-term loss of 5% but overall gain of 17%.

I still look to hold this position through the end of September, at which point I’ll tighten my stop losses considerably in order to lock in gains. My only stop loss, at the moment, is to buy back the sold puts at 101, at which point I plan to earn extra income in the (very) short term by delaying the sale of the purchased puts for this condor.

RATIONALE

As you can see from this chart, we’re approaching the same price level as the bottom of the October 2008 gap in the S&P 500. Technically speaking, this is the last significant near-term resistance level for the index before “clear blue skies” up above.

As you can see from this chart, we’re approaching the same price level as the bottom of the October 2008 gap in the S&P 500. Technically speaking, this is the last significant near-term resistance level for the index before “clear blue skies” up above.

One of two outcomes will occur:

Posted in 10/09 Long Iron Condor | Tags: $SPY, iron condor, long iron condor, october, S&P 500, SPYJH, swgjb, swgje